Which Depreciation Method Is Used For New Roof

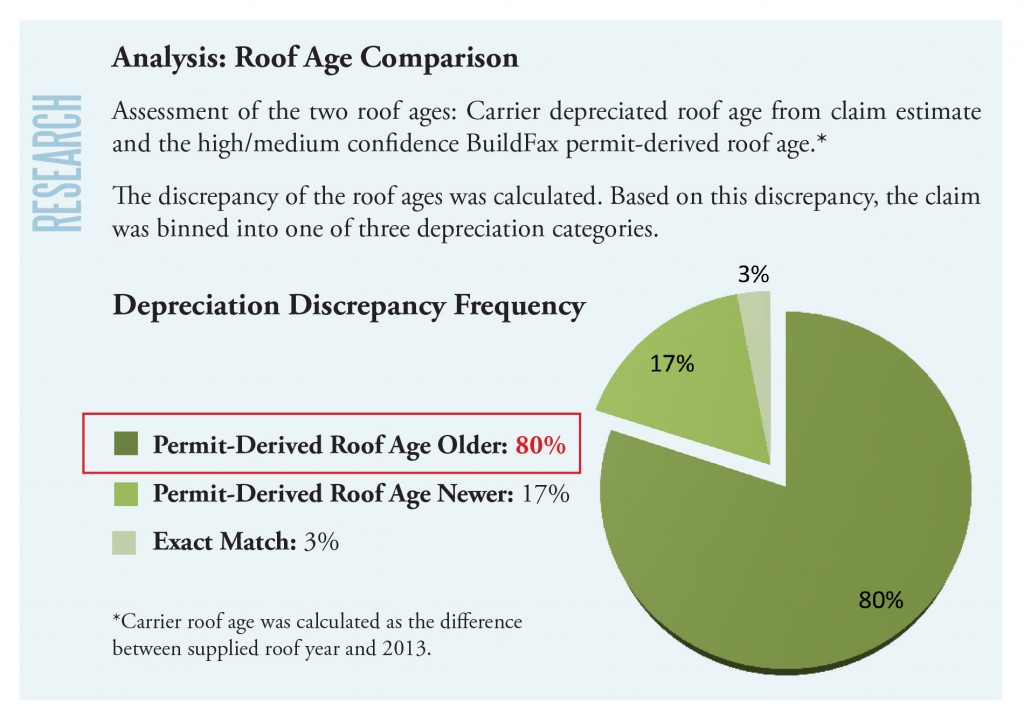

Alice elects to use the cpi index method to determine the basis of the old roof which was placed in service ten years ago.

Which depreciation method is used for new roof. I own a condo that i rent out. The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings. The best course of action that you could take at this point would be to invest in a brand new state of the art system. Calculating depreciation begins with two factors.

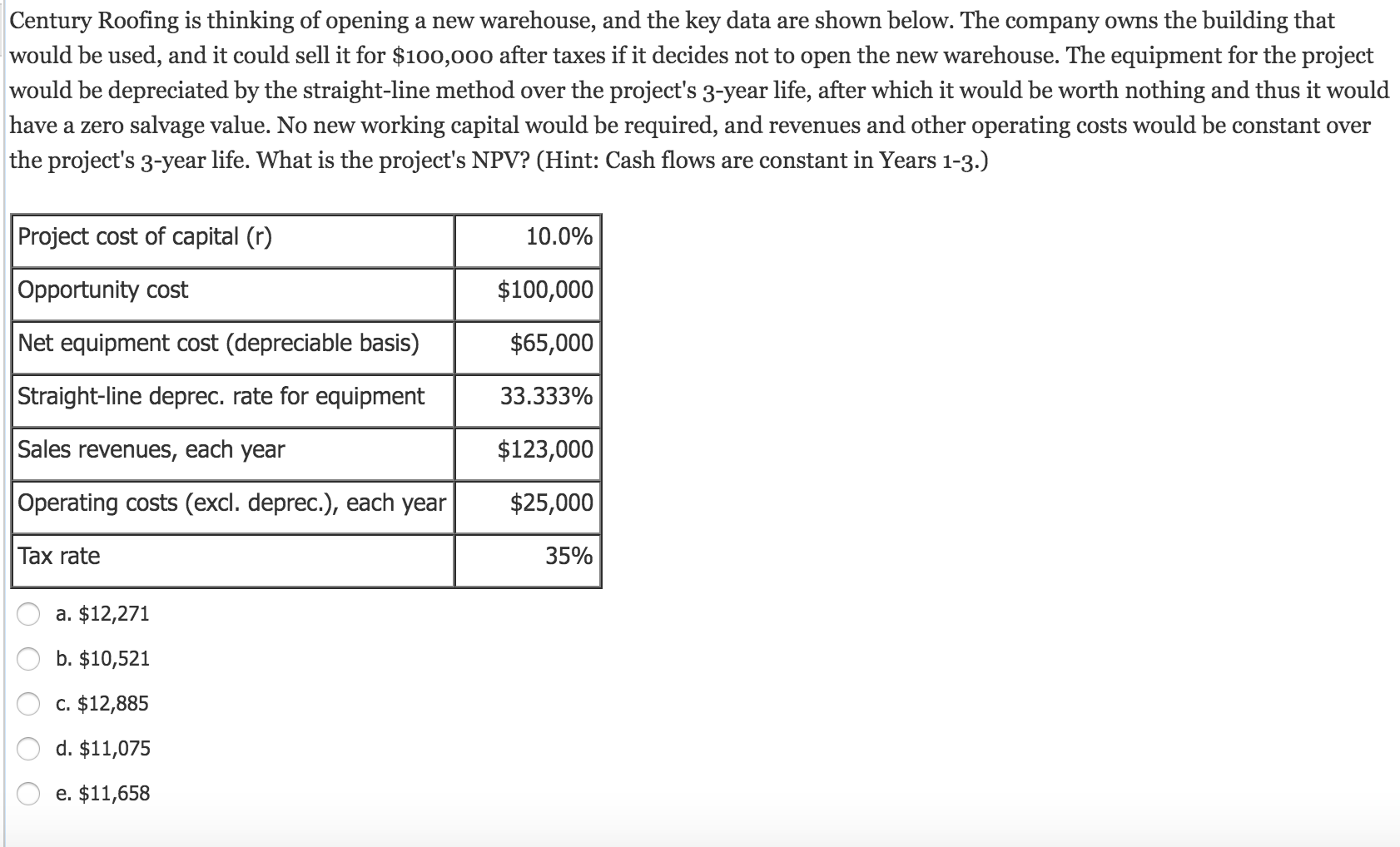

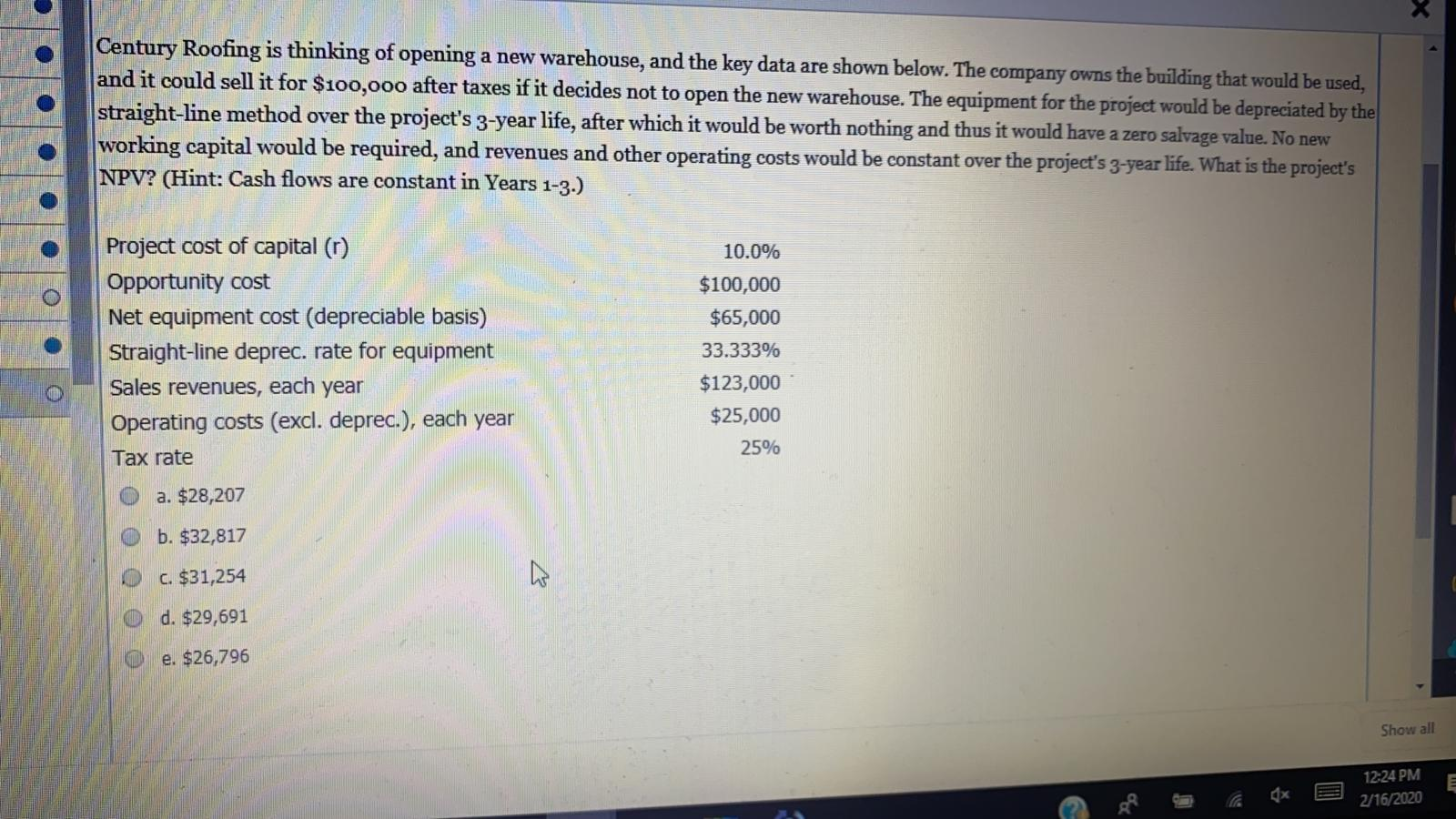

Straight line depreciation is the most straightforward method for calculating a new roof s depreciation. Using any other reasonable method. Or any ideas the date of install was 10 31 2018 and depreciation method was sl. 1 your basis in the property 2 the recovery period for the property and 3 the depreciation method used.

However under the old laws this would be rather difficult. Three factors determine how much depreciation you can deduct each year. The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years. From what i ve read about this special depreciation allowance it doesn t seem like i should be able to instead i should have to depreciate it over.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property. The cpi has risen by 24 7 over the last 10 years so the old roof s placed in service year cost is valued at 7 530. You can t simply deduct your mortgage or principal payments or the cost of furniture fixtures and equipment as an expense. Since the roof is newer than the structure itself the roof will technically lose its value after the building.

We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors. Any comments if it could be correct. At the end of last year the roof for the entire building was replaced. She spent 10 000 to replace the roof this year.

This is because before a business could only make a tax claim on these installations after they slowly depreciated over 39 years. The roof cost 5482 but after putting all the information in it only depreciated 42 for 27 5 years. Once you know the start date calculating the depreciation is reasonably straightforward. I input this information into turbotax and it ask me if i d like to use a special depreciation allowance and deduct the entire expense this year.

Macrs convention was mm any help would be appreciated. Improvements are depreciated using the straight line method which means that you must deduct the same amount every year over the useful life of the roof. The depreciation is the same for each year of the roof s useful life. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.