What Does Harp Stand For Mortgage

If you qualify for harp refinancing you may be able to save a significant amount of money by lowering your monthly payment reducing your interest rate switching from an adjustable rate mortgage to a fixed rate mortgage or shortening your mortgage term from 30 years to 15 or 20 years.

What does harp stand for mortgage. By using your. What does harp stand for in mortgage. How does harp work. Top harp abbreviation related to mortgage.

What does harp mortgage stand for it is recommended for financing major one off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. Harp is designed to help homeowners with or without private mortgage insurance pmi and lender paid mortgage insurance lpmi. High adventure role playing is one option get in to view more the web s largest and most authoritative acronyms and abbreviations resource. The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan.

The general rule of thumb is that if you have mortgage insurance your new harp mortgage must have the same level of coverage. The home affordable refinance program harp is a federal program of the united states set up by the federal housing finance agency in march 2009 to help underwater and near underwater homeowners refinance their mortgages unlike the home affordable modification program hamp which assists homeowners who are in danger of foreclosure this program benefits homeowners whose mortgage payments. Home affordable refinance program. Mortgage harp abbreviation meaning defined here.

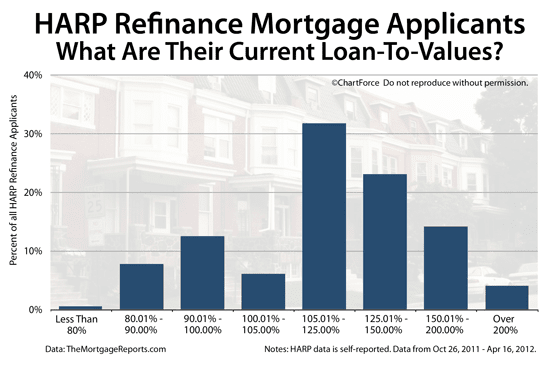

This opens up the program to an entirely new and much larger pool of borrowers. A harp loan is short hand for the home affordable refinance program that was created after the 2008 mortgage crisis by the federal housing finance agency fhfa. The goal of harp loans is to help homeowners who have little to no equity in their homes to refinance their mortgage. Harp was aimed at borrowers who had a loan to value ratio ltv of greater than 80.

First unlike its predecessor harp 2 0 allows borrowers with mortgage insurance to qualify for a refi.